vancouver multiplex zoning: 4 steps to evaluate your property and maximize value

Vancouver’s zoning landscape has shifted. With the introduction of the R1-1 Residential Inclusive Zone, many single-family homes are now eligible for multiplex development—opening the door to increased density, higher resale values, and new opportunities for landowners across the city.

If your lot qualifies, you could build up to six strata-titled units or eight secured rental units. And even if you’re not a builder yourself, developers are actively searching for sites like yours. But to unlock the full potential, you need more than just eligibility—you need a strategy.

This guide outlines a clear four-step process to help you determine whether your property qualifies, what development options offer the greatest value, how to time your sale, and how to position your land to attract strong offers.

understand what multiplex zoning allows

Multiplexes are small multi-unit buildings that offer an alternative to both single-family homes and large apartment blocks. They typically include 3–6 units on a single lot, with up to 8 units allowed if all are secured rentals.

The R1-1 zoning now permits multiplexes city-wide on parcels that were previously limited to detached housing. This opens the door to creative, higher-density housing types—and for landowners, it means more value, more options, and more interest from developers.

step 1: assess your property’s eligibility

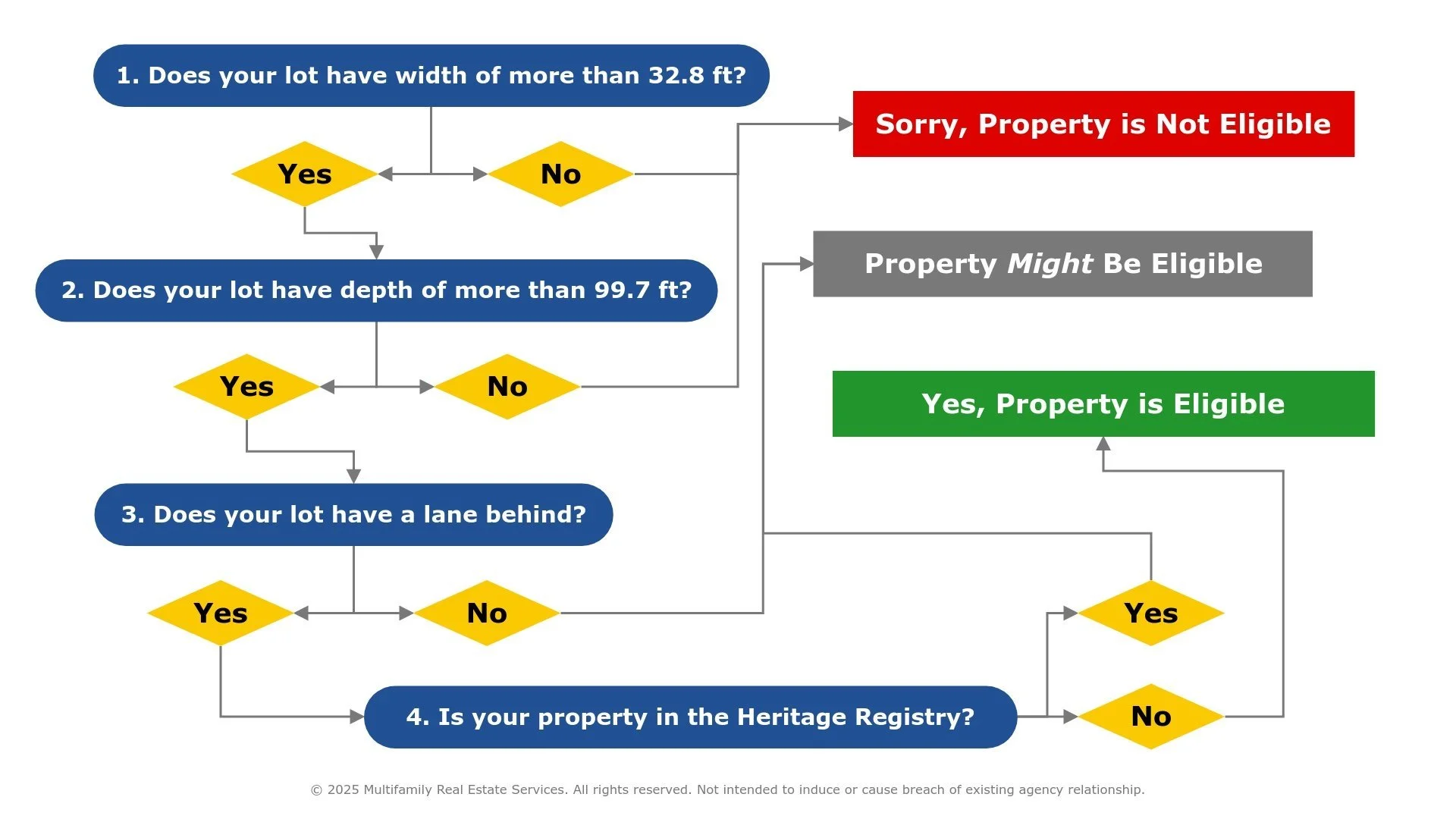

Not every lot qualifies for multiplex development, so the first step is understanding whether your property meets the City of Vancouver’s requirements. Eligibility is based on lot size, width, access, and environmental constraints.

Use BC Assessment and VanMap to confirm your lot’s dimensions and official designations, then compare them against the key criteria below.

Zoning Regulations – Unit Count by Lot Size

3–4 units: minimum lot size ~3,294 sq ft

5 units: minimum lot size ~4,994 sq ft

6–8 units: minimum lot size ~5,995 sq ft

7–8 units only allowed as secured rental housing

Site Requirements

Lot width

32.8 ft: minimum for up to 4 units

44 ft: required for 5 units

50 ft: required for 6 units

Access

Street frontage required

Rear access via laneway or future laneway dedication

Environmental

Property must not be in a floodplain

Tree retention policies apply (preservation or planting required)

If your site meets these criteria, it may be eligible for a development permit under R1-1. If not, consider options like land assembly or policy inquiry for edge cases.

multiplex eligibility decision tree

step 2: determine your property’s highest and best value

Just because you can build more units doesn’t mean it’s the most profitable path. The goal is to determine the highest and best use—the development scenario that creates the greatest return.

Sometimes that’s a new 6-unit strata. Other times it might be a duplex or even a renovated single-family home. It depends on construction costs, market demand, and how developers calculate returns.

Scenarios to Evaluate

Single-family home: Strong pricing in established areas; may outperform low-density redevelopment

Duplex: Two titled homes with relatively low construction costs

Multiplex (3–6 strata or 8 rentals): Highest unit count, but requires careful analysis of cost, revenue, and zoning fees

Land assembly: Combine with neighbouring lots to unlock scale; useful in key corridors or corner parcels

Key Questions to Ask

Does land value exceed current residential value?

What are developers building and selling in my neighbourhood?

Would a niche use (e.g. family-sized rental) yield stronger returns?

Are there zoning constraints or city fees that could reduce value?

Critical Fee to Understand

Amenity Share Cost:

Applies to density above 0.70 FSR

Charged at up to $65 per buildable square foot

Example: On a 6,000 sq ft lot, this could add $117,000 in extra fees

Common Valuation Methods

Direct Comparison – Based on sales of similar properties

Income Approach – Based on projected rent and cap rates

Residual Land Value – Project value minus hard costs, soft costs, and developer profit

Understanding each scenario—and how a developer would model it—is the key to pricing your land effectively.

compare all potential uses to find highest and best

A thorough evaluation must include each of these options.

step 3: evaluate market trends and timing

Even the best site needs the right market conditions. Timing your sale can affect your final price as much as zoning or lot size. Monitor local data and align your strategy with broader demand.

Key Market Indicators

Median Home Price – Indicates overall buyer confidence

Inventory (Months of Supply) – Low supply = more developer competition

Days on Market (DOM) – Short DOM suggests strong activity

Sales Volume – Measures momentum in the market

Sale-to-List Price Ratio – Over 100% = properties selling above asking

Demographics That Matter

Population growth and interprovincial migration

Millennials and Gen Z creating new demand for smaller, multi-unit housing

High housing costs forcing demand toward efficient formats

Smaller household sizes driving interest in multiplex-style homes

Cultural diversity influencing design and layout preferences

Smart developers are watching these trends closely. Understanding how your site fits into that bigger picture can help you time your listing—and craft your message—to align with buyer priorities.

minimum market analysis requirements

step 4: position your property for maximum value

Once you’ve confirmed potential and assessed market conditions, the final step is packaging your property for sale in a way that attracts the right kind of buyers: experienced, well-capitalized developers.

Most sellers fall short here. They focus on the home, not the opportunity. But in a multiplex zoning context, you’re not selling a house—you’re selling a site.

Common Mistakes to Avoid

Listing without reference to development potential

No supporting documents, visuals, or feasibility info

Marketing to general buyers instead of experienced developers

Underestimating zoning complexity, and losing ground in negotiations

Strategies to Maximize Value

Present a clear vision: unit counts, example layout, or concept study

Outline key zoning highlights and constraints

Highlight any environmental or design advantages (e.g. corner lot, lane access)

Disclose Amenity Share Cost and how it’s been factored into price

Work with a broker experienced in multiplex sites and developer negotiations

A well-positioned site reduces buyer uncertainty—and that drives up pricing. In many cases, a compelling information package and direct outreach to qualified buyers can add hundreds of thousands of dollars to your sale price.

a complete multiplex land sale strategy must include all of these elements

conclusion: clarity unlocks value

Vancouver’s multiplex zoning represents a major shift—and a major opportunity. If your property qualifies, you’re holding more than a home; you’re holding significant potential. But realizing that potential requires specialized expertise.

An experienced broker doesn’t just list your property—they uncover hidden value, position your site effectively for developers, and negotiate confidently, protecting you from common mistakes that can cost tens or even hundreds of thousands of dollars. Without strategic guidance, you risk leaving substantial money on the table or facing prolonged delays and collapsed deals.

If you’d like a relaxed, discreet conversation about your property and how the new multiplex rules could positively impact your financial future, I’m here to help. Let’s explore your options clearly—before opportunities pass you by.

-

City of Vancouver. (n.d.). Build a multiplex dwelling. https://vancouver.ca/home-property-development/build-a-multiplex-dwelling.aspx

City of Vancouver. (n.d.). Housing options in lower density areas. https://vancouver.ca/people-programs/housing-options-in-lower-density-areas.aspx

City of Vancouver. (n.d.). Low density housing options how-to guide [PDF]. https://guidelines.vancouver.ca/bulletins/bulletin-low-density-housing-options-how-to-guide.pdf

City of Vancouver. (n.d.). R1-1 district schedule [PDF]. https://bylaws.vancouver.ca/zoning/zoning-by-law-district-schedule-r1-1.pdf

City of Vancouver. (n.d.). Shape Your City: Multiplexes FAQ. https://www.shapeyourcity.ca/multiplexes/widgets/142819/faqs#31291

Daniel Clarke Architect Inc. (n.d.). Multifamily architecture – Small-scale multiplex housing. https://www.dclarkearchitect.com/multifamily

Multifamily Real Estate Services. (n.d.). Understanding rezoning and multifamily development terms. https://multifamily.ca/resources/understanding-rezoning-and-multifamily-development-terms